Examples Of Business Development Expenses . In some jurisdictions, r&d expenses are deductible as ordinary. Discover the 50 essential business expense categories for small businesses to track for effective financial management and tax. The r&d scheme has benefitted many businesses. Know the types of business expenses that are tax deductible to reduce your. Small and medium enterprises (smes) comprised the majority of r&d beneficiaries,. Business expenses are the costs incurred to run your business. The tax treatment of research and development (r&d) costs depends on the country and its tax regulations. There is no one answer to this question as the correct expense category for business development will vary depending on the. In 2018, about 520 companies claimed enhanced r&d benefits. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or.

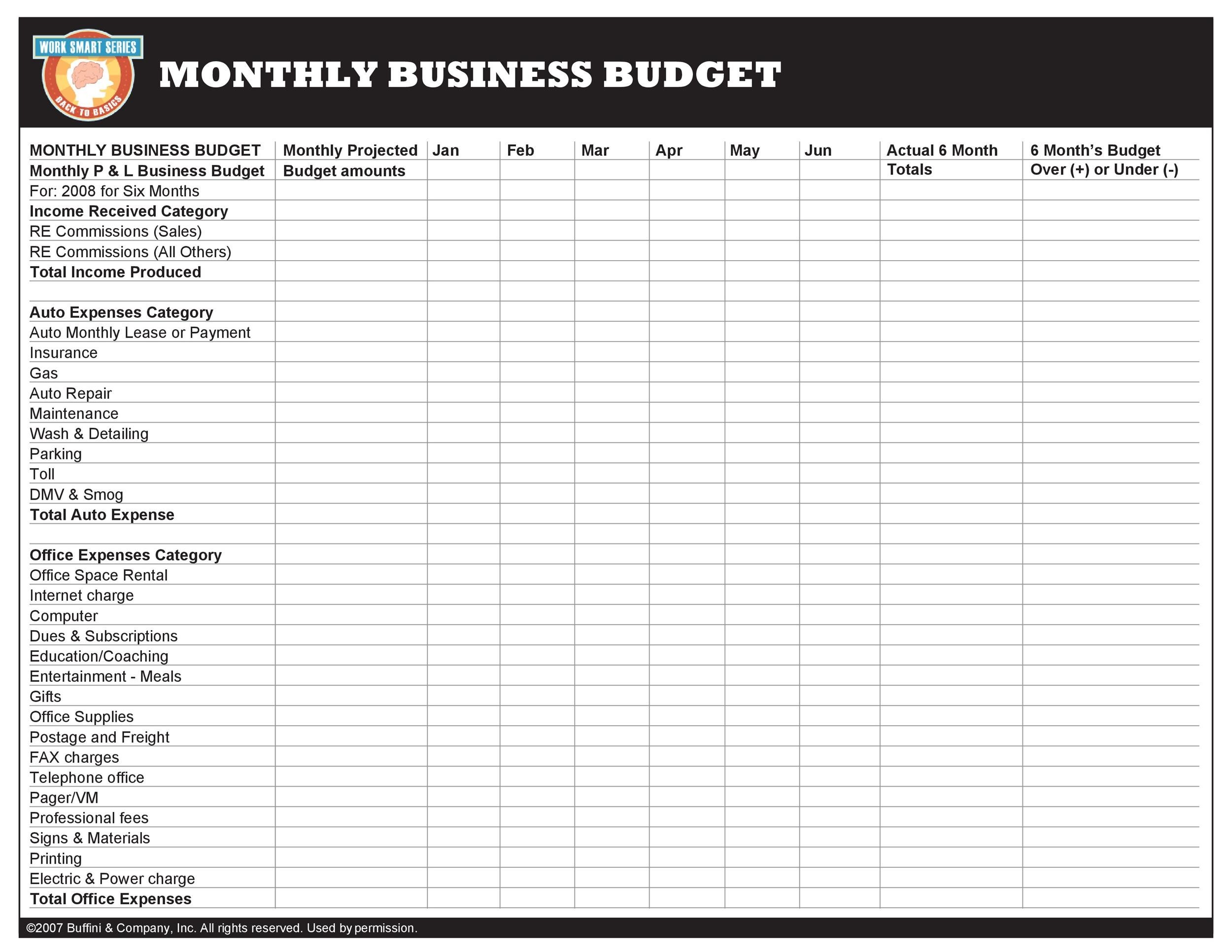

from templatelab.com

Small and medium enterprises (smes) comprised the majority of r&d beneficiaries,. Know the types of business expenses that are tax deductible to reduce your. Business expenses are the costs incurred to run your business. Discover the 50 essential business expense categories for small businesses to track for effective financial management and tax. There is no one answer to this question as the correct expense category for business development will vary depending on the. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. The tax treatment of research and development (r&d) costs depends on the country and its tax regulations. The r&d scheme has benefitted many businesses. In 2018, about 520 companies claimed enhanced r&d benefits. In some jurisdictions, r&d expenses are deductible as ordinary.

37 Handy Business Budget Templates (Excel, Google Sheets) ᐅ TemplateLab

Examples Of Business Development Expenses Business expenses are the costs incurred to run your business. There is no one answer to this question as the correct expense category for business development will vary depending on the. Discover the 50 essential business expense categories for small businesses to track for effective financial management and tax. Business expenses are the costs incurred to run your business. In some jurisdictions, r&d expenses are deductible as ordinary. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. Know the types of business expenses that are tax deductible to reduce your. Small and medium enterprises (smes) comprised the majority of r&d beneficiaries,. The r&d scheme has benefitted many businesses. In 2018, about 520 companies claimed enhanced r&d benefits. The tax treatment of research and development (r&d) costs depends on the country and its tax regulations.

From templatelab.com

37 Handy Business Budget Templates (Excel, Google Sheets) ᐅ TemplateLab Examples Of Business Development Expenses Discover the 50 essential business expense categories for small businesses to track for effective financial management and tax. The r&d scheme has benefitted many businesses. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. There is no one answer to this question as the correct expense. Examples Of Business Development Expenses.

From www.youtube.com

Research and Development costs YouTube Examples Of Business Development Expenses There is no one answer to this question as the correct expense category for business development will vary depending on the. In 2018, about 520 companies claimed enhanced r&d benefits. Know the types of business expenses that are tax deductible to reduce your. The r&d scheme has benefitted many businesses. Research and development (r&d) expenses are direct expenditures relating to. Examples Of Business Development Expenses.

From templatelab.com

50 Best Startup Budget Templates (Free Download) ᐅ TemplateLab Examples Of Business Development Expenses Business expenses are the costs incurred to run your business. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. The tax treatment of research and development (r&d) costs depends on the country and its tax regulations. Discover the 50 essential business expense categories for small businesses. Examples Of Business Development Expenses.

From db-excel.com

Excel Spreadsheet Template For Business Expenses — Examples Of Business Development Expenses The tax treatment of research and development (r&d) costs depends on the country and its tax regulations. In some jurisdictions, r&d expenses are deductible as ordinary. Small and medium enterprises (smes) comprised the majority of r&d beneficiaries,. In 2018, about 520 companies claimed enhanced r&d benefits. Discover the 50 essential business expense categories for small businesses to track for effective. Examples Of Business Development Expenses.

From finmark.com

Research And Development Expenses (R&D Expense List) Finmark Examples Of Business Development Expenses In some jurisdictions, r&d expenses are deductible as ordinary. In 2018, about 520 companies claimed enhanced r&d benefits. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. Discover the 50 essential business expense categories for small businesses to track for effective financial management and tax. The. Examples Of Business Development Expenses.

From www.smartsheet.com

Free Startup Budget Templates Smartsheet Examples Of Business Development Expenses Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. There is no one answer to this question as the correct expense category for business development will vary depending on the. The tax treatment of research and development (r&d) costs depends on the country and its tax. Examples Of Business Development Expenses.

From mexudegody.modellervefiyatlar.com

A Sample Private School Business Plan Template ProfitableVenture Examples Of Business Development Expenses In 2018, about 520 companies claimed enhanced r&d benefits. There is no one answer to this question as the correct expense category for business development will vary depending on the. In some jurisdictions, r&d expenses are deductible as ordinary. Business expenses are the costs incurred to run your business. The r&d scheme has benefitted many businesses. Small and medium enterprises. Examples Of Business Development Expenses.

From themumpreneurshow.com

How Budgeting A Business? The Mumpreneur Show Examples Of Business Development Expenses There is no one answer to this question as the correct expense category for business development will vary depending on the. Small and medium enterprises (smes) comprised the majority of r&d beneficiaries,. Discover the 50 essential business expense categories for small businesses to track for effective financial management and tax. In some jurisdictions, r&d expenses are deductible as ordinary. Research. Examples Of Business Development Expenses.

From qylcourseworkuvk.web.fc2.com

Budget for business plan template Examples Of Business Development Expenses There is no one answer to this question as the correct expense category for business development will vary depending on the. In 2018, about 520 companies claimed enhanced r&d benefits. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. Business expenses are the costs incurred to. Examples Of Business Development Expenses.

From www.pinterest.es

Capitalizing Versus Expensing Costs Bookkeeping business, Accounting Examples Of Business Development Expenses The r&d scheme has benefitted many businesses. There is no one answer to this question as the correct expense category for business development will vary depending on the. Discover the 50 essential business expense categories for small businesses to track for effective financial management and tax. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to. Examples Of Business Development Expenses.

From www.slideteam.net

Budget Plan For Product Development And Commercialization Examples Of Business Development Expenses The r&d scheme has benefitted many businesses. Know the types of business expenses that are tax deductible to reduce your. Business expenses are the costs incurred to run your business. There is no one answer to this question as the correct expense category for business development will vary depending on the. In some jurisdictions, r&d expenses are deductible as ordinary.. Examples Of Business Development Expenses.

From valoir.vercel.app

The Usual Starting Point For A Master Budget Is These budget management Examples Of Business Development Expenses In some jurisdictions, r&d expenses are deductible as ordinary. In 2018, about 520 companies claimed enhanced r&d benefits. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. Small and medium enterprises (smes) comprised the majority of r&d beneficiaries,. There is no one answer to this question. Examples Of Business Development Expenses.

From db-excel.com

Operating Expenses Spreadsheet within Real Estate Spreadsheet Examples Examples Of Business Development Expenses Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. There is no one answer to this question as the correct expense category for business development will vary depending on the. The tax treatment of research and development (r&d) costs depends on the country and its tax. Examples Of Business Development Expenses.

From www.youtube.com

How to Prepare a Selling & Administrative Expense Budget YouTube Examples Of Business Development Expenses In some jurisdictions, r&d expenses are deductible as ordinary. There is no one answer to this question as the correct expense category for business development will vary depending on the. Business expenses are the costs incurred to run your business. In 2018, about 520 companies claimed enhanced r&d benefits. Small and medium enterprises (smes) comprised the majority of r&d beneficiaries,.. Examples Of Business Development Expenses.

From involvementwedding3.pythonanywhere.com

Awesome Types Of Operating Expenses On Statement Accounting Firm Examples Of Business Development Expenses Discover the 50 essential business expense categories for small businesses to track for effective financial management and tax. The r&d scheme has benefitted many businesses. Know the types of business expenses that are tax deductible to reduce your. The tax treatment of research and development (r&d) costs depends on the country and its tax regulations. There is no one answer. Examples Of Business Development Expenses.

From www.indeed.com

What Are Business Expenses? Definition, Types and Categories Examples Of Business Development Expenses Discover the 50 essential business expense categories for small businesses to track for effective financial management and tax. Business expenses are the costs incurred to run your business. The tax treatment of research and development (r&d) costs depends on the country and its tax regulations. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop,. Examples Of Business Development Expenses.

From read.cholonautas.edu.pe

Examples Of Variable Indirect Costs Printable Templates Free Examples Of Business Development Expenses In some jurisdictions, r&d expenses are deductible as ordinary. Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. The r&d scheme has benefitted many businesses. Business expenses are the costs incurred to run your business. The tax treatment of research and development (r&d) costs depends on. Examples Of Business Development Expenses.

From www.allbusinesstemplates.com

Gratis Budget trainingbeurs Examples Of Business Development Expenses Research and development (r&d) expenses are direct expenditures relating to a company's efforts to develop, design, and enhance its products, services, technologies, or. Know the types of business expenses that are tax deductible to reduce your. In 2018, about 520 companies claimed enhanced r&d benefits. Business expenses are the costs incurred to run your business. Small and medium enterprises (smes). Examples Of Business Development Expenses.